A personalised automated banking experience using AI

EBO recently introduced AI into BNF Bank's customer journey. This enabled the organisation to maximise the opportunity to interact with customers, find a more efficient way to qualify leads and capture customer data.

About BNF Bank

BNF Bank plc, is an established key player in the banking sector, offering individual and business clients a highly personalised and tailor-made service through a network of retail branches and a Corporate and Business Banking Centre.

What Goals Did BNF Bank Have?

A surge in customer enquiries and high dependency on manual processing, was leading to time-lag, business inefficiency and long waiting periods for customers. The bank needed a solution.

BNF’s physical operation was not able to scale up with flexibility to handle the influx of requests and so customer experience gaps were being created. Workload, staff attrition and budget constraints further aggravated this gap and led to loss of leads.

BNF Bank wanted to adapt to today's digitally-savvy customers and reach its clients expectations. The bank needed a digital solution that offered human interaction at scale, maximised opportunities and delivered an excellent customer experience.

The Challenge

Prior to adopting Artificial Intelligence into its customer support system, BNF Bank handled its client queries and interactions via semi-manual sorting and response. This led to a time-lag and long waiting periods for customers, one of the biggest contributing factors to poor customer experience in the finance industry (The Financial Brand, 2017).

BNF’s physical operation was not able to scale up with such flexibility to handle the influx of requests and so additional customer experience gaps were being created during periods of high demand. Workload, staff attrition or budgetary constraints further aggravated this gap and led to loss of leads coming through during non-working hours.

BNF Bank also wanted to adapt and meet the needs of today's increasingly digital-savvy customers who, in fact, expect financial services to use emerging technologies to make banking easier (Edelman, 2019). To do this, the organisation required a digital solution that offered human interaction at scale, maximised every opportunity and interaction with customers and ultimately, enhanced customer experience.

The Solution

Immediate and efficient customer engagement

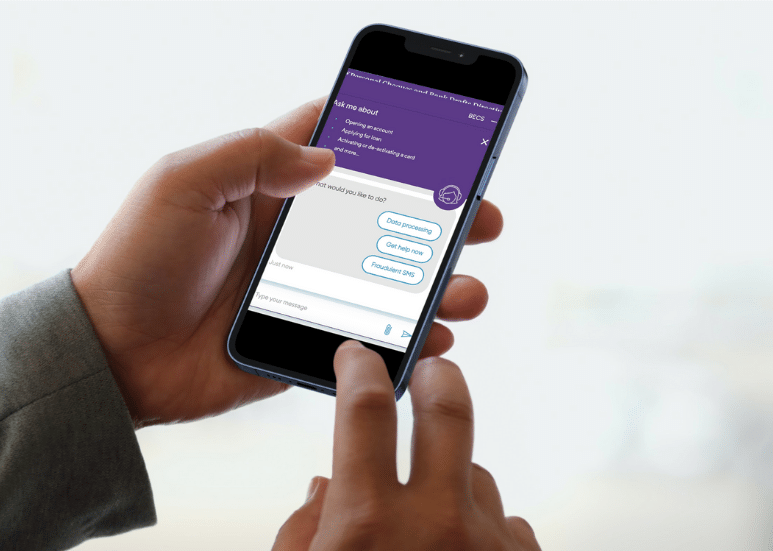

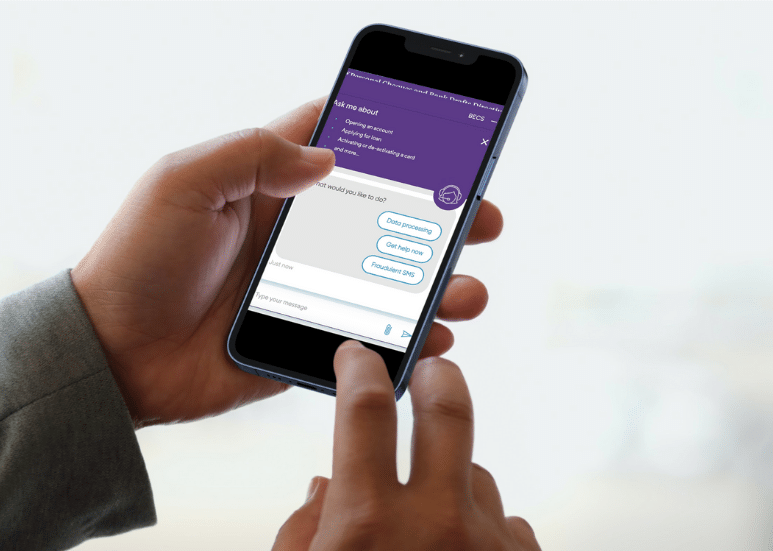

EBO created a custom-built Virtual Agent (VA), named Becs, to automate a majority of BNF Bank’s customer service. Responding to customers instantly and on a 24/7 basis, has allowed the Bank to capture leads that would usually be lost during out-of-office hours. EBO implemented the Artificial Intelligence VA across the bank’s Facebook channels and website, to ensure accessibility to customers and reduce operating costs associated with the service.

Continuous improvement

The Virtual Agent led to improvements in customer experience through the use of Natural Language Processing (NLP) which uses language dialogues and workflows to answer users' queries. Its Artificial Intelligence capabilities allow the VA to learn as it goes along, continuously updating its language library and complexity of workflows. At the same time, EBO's NLP engineers carry out performance reviews on an ongoing basis to optimise the VA and ensure that its NLP is recognising the user's intents effectively.

Increased customer lifetime value

The intelligent conversational agent can talk to each customer personally, understanding the context of the conversation as well as the emotions, intent and tone. Furthermore, the VA helps to improve customer lifetime value by remembering customer preferences and maintaining a relationship with the customer after their initial interaction.

Enhanced lead qualification

The VA has been trained to answer a vast range of customer intents, from booking appointments to opening loans. On interaction, EBO's VA qualifies the incoming lead and directs it to the correct department, ensuring staff works on the right prospects. Should a conversation require human takeover, the Bank's staff can easily access the backend interface to handle the chat and continue the conversation.

Deeper understanding of customers

The backend interface provides BNF Bank with a vast range of data captured from the customer dialogues. This data provides the organisation with a deeper understanding of their customers, ultimately enabling them to make informed strategic decisions based on analysis and predictions as well as do away with complex software to collect and analyse results.

The Result

In just three months, BNF Bank’s Virtual Agent, Becs handled hundreds of conversations. Each conversation was handled entirely by the VA, from start to finish, requiring no human intervention. This is a significant result showing the reliability of the VA and its ability to reduce customer waiting time, increase customer satisfaction and save the company time and resources.

The increasing customer usage and interaction with the organisation's Virtual Agent, reveals that BNF is on the right track in adapting its service towards today's digital-savvy customer whilst managing to upscale its operation in a cost-effective and highly productive way.