In today’s banking world, customers expect more than efficiency, they crave empathy. As digital channels expand, the challenge isn’t just about adopting AI, it’s about humanising it. That’s the theme that powered EBO’s latest fintech webinar: “Humanising AI in Banking: Creating a Meaningful Customer Experience.”

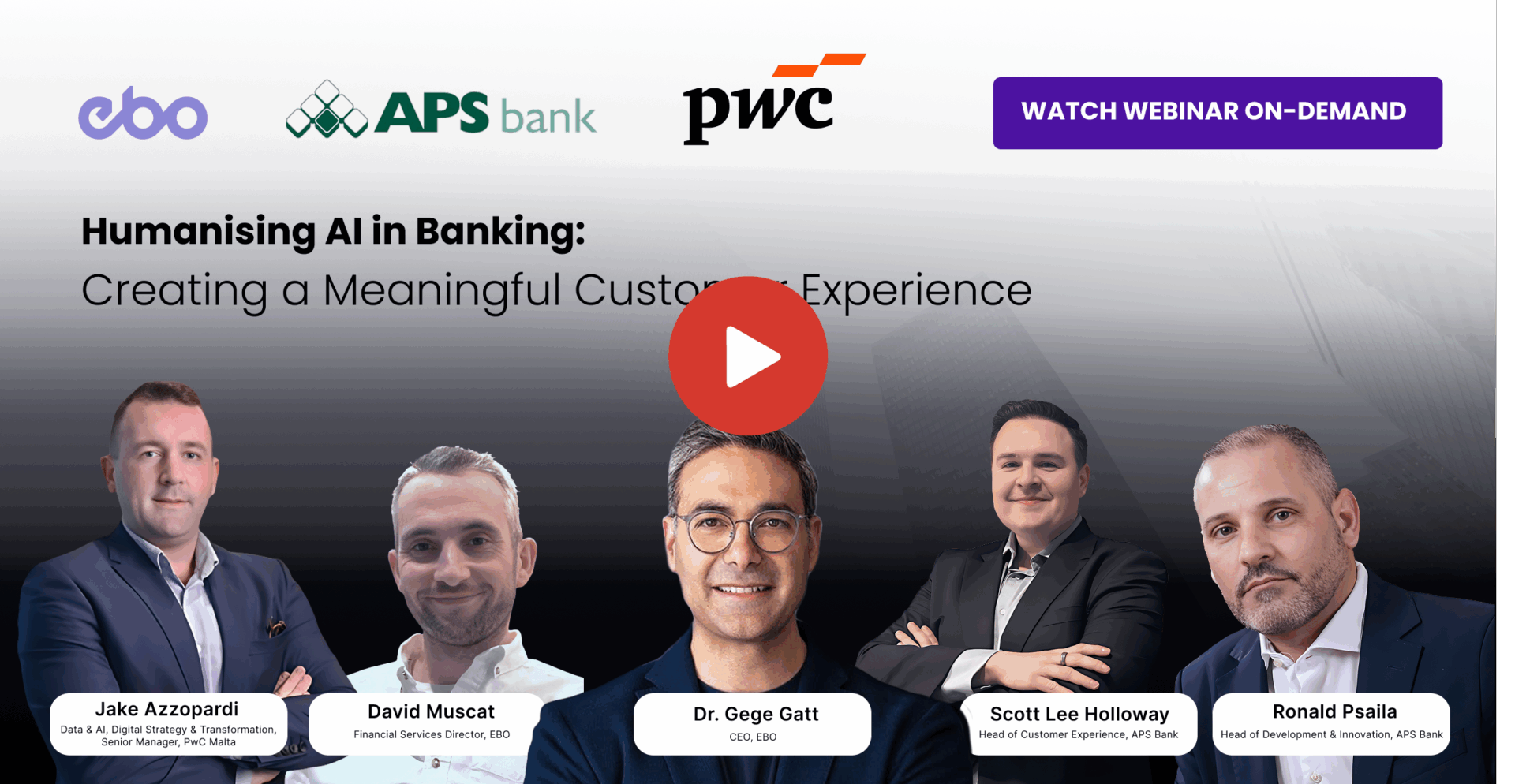

Hosted by EBO and joined by leaders from APS Bank, EBO and PwC Malta, the webinar explored how cutting-edge AI is transforming the way banks, EMIs and financial institutions connect, serve, and build trust with their customers.

Here are the key takeaways that emerged from this inspiring industry-led discussion.

8 Ways AI is Humanising the Future of Banking according to EBO’s CEO

Dr. Gege Gatt, CEO of EBO, opened the session with a simple truth:

“For 25 years, digitalisation has made banking more efficient — but less emotional.”

While digitalisation has made banking faster and more efficient over the past 25 years, it has also made it less human and emotionally connected. He challenged the industry to move beyond transactional AI toward conversational intelligence systems that don’t just process requests, but build authentic, emotionally aware connections with customers. This is the essence of humanised AI: shifting the focus from mere transactions to trust, ensuring every interaction feels clear, purposeful, and tailored to the individual’s needs.

Take a glimpse at the highlights here, and watch the full session to explore all eight in detail.

Scaling Customer Service with Heart

Scott Lee Holloway, Head of Customer Experience at APS Bank, shared how APS, in close partnership with EBO, leveraged AVA, their virtual assistant, to meet the challenges of rapid growth and rising customer expectations.

“We wanted to reduce customer wait times…so our colleagues could focus on the more complex queries that require our expertise.”

AVA now provides 24/7 support and streamlines appointment booking, freeing staff for high-value interactions.

Scott emphasised the human element: “We brought our colleagues along on the journey…they helped us build AVA in a way that was going to best support our customers.” With EBO’s guidance, APS created a scalable, human-centered solution that keeps the customer at the heart of everything.

How APS Bank and EBO Keep AI Running Smoothly

Implementing AI isn’t just about technology, it’s about precision, oversight, and constant fine-tuning.

Ronald Psaila, Head of Development and Innovation at APS Bank explains,

“Every software solution comes up with its own challenges…that’s why partners like EBO are very much important because they can help you resolve these issues in a reasonable and appropriate time.”

From piloting and change management to continuous monitoring, APS Bank and EBO work hand-in-hand to ensure AVA delivers real value for customers while learning and improving every step of the way.

It’s a continuous cycle of learning, adjusting, and improving, with EBO providing the expertise to tackle the technical and operational challenges along the way.

The result? An AI solution that’s reliable, responsive, and truly customer-focused.

Innovating Fast, Governing Smart

Banks are racing to adopt AI, but moving fast comes with inherent risks. Jake Azzopardi, Data & AI, Digital Strategy & Transformation, Senior Manager at PwC Malta, highlighted that:

“Not all AI use cases carry the same risk,” and successful implementation requires a tiered, responsible approach."

High-risk applications, like credit evaluation, demand stricter oversight, while lower-risk areas, such as customer service, can support incremental innovation.

Embedding governance from the very start, fostering AI literacy across the organisation, and involving customers in design and testing, allowing banks to push the boundaries of digital transformation without compromising accountability or customer confidence.

EBO's AI Live in Action!

David Muscat, Financial Services Director at EBO, brought the above principles to life through a live demo of EBO’s virtual assistant, Jane, showcasing how conversational AI can engage players in their native language, adapt to individual communication styles, and integrate seamlessly with back-office systems.

“Our virtual agents can speak over 100 languages, even Farsi and simplified Chinese — making inclusivity scalable.”

Jane demonstrated empathy and contextual awareness, acknowledging player issues, verifying users securely, and escalating to human agents when emotional judgment was required.

Curious to see how it works?

Curious to see how it works?

Book a consultation with David Muscat and discover how EBO’s AI can elevate engagement, efficiency, and trust.

Missed the live session?

👉 Watch the full replay on-demand by filling out the form here.