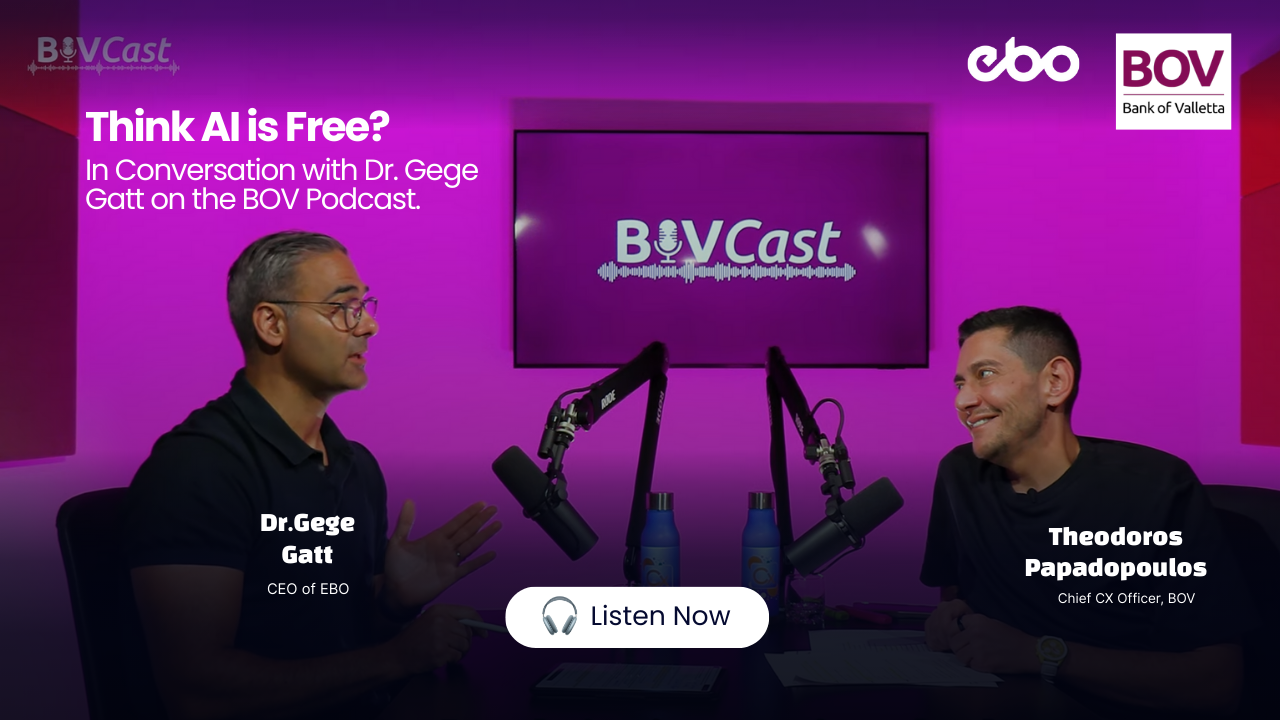

AI is everywhere, but is it really free? In the latest BOVCast episode, organised by Bank of Valletta (BOV), CEO of EBO, Dr. Gege Gatt, sat down with Theodoros Papadopoulos, CCXO at Bank of Valletta, to explore the hidden costs of AI and how it impacts our work, privacy, and digital lives. Together they discuss the importance of accuracy and transparency in AI, the need for digital clinics and explore how to stop AI from learning the wrong lessons.

Here’s a closer look at the most compelling takeaways from their conversation.

Think AI is free? Think again.

It’s easy to assume that AI tools, chatbots, recommendation engines, or virtual assistants come without a price.

While many view AI as a free and accessible tool, Gatt emphasised that there is always a price, often unseen. This perspective challenges the common perception that AI tools are simply gifts of technology.

Instead, businesses and individuals alike must consider what data they are trading in order to benefit from these innovations.

"The biggest lie we’ve been told about AI is deceptively simple: AI is free.”

Is AI in the Workplace a Double-Edged Sword?

AI is reshaping workplaces across industries. It can automate repetitive tasks, enhance decision-making, and even generate creative insights. But as Gatt highlighted, this power comes with accountability:

“Companies need to understand not just the power of AI, but also the responsibility that comes with deploying it responsibly in their operations.”

From customer service and marketing to analytics, organisations are increasingly integrating AI into their workflows. Yet, with every implementation comes ethical considerations, bias in algorithms, transparency in decision-making, and fair treatment of workers. Gatt’s insights underscore that AI’s promise is inseparable from the responsibility it demands.

Can We Innovate Without Sacrificing Privacy?

Perhaps the most pressing issue in AI today is the tension between innovation and privacy. Predictive algorithms and personalised experiences rely on extensive data collection.

Gege and Theodoros discussed the importance of transparency and thoughtful data practices.

"Understanding the trade-offs is essential not just for compliance, but for trust. Companies that respect privacy while leveraging AI are more likely to earn the long-term loyalty of their customers."

What's HITL: Human in the Loop?

Gege Gatt mentions that one of the core principles of the EU AI Act, which is currently being rolled out and will have major implications for industries like banking, is the idea of human in the loop (HITL).

This principle ensures that humans remain central to the design and deployment of AI systems, maintaining the ability to understand, intervene, and even halt an AI process if necessary.

At EBO, for example, we build technologies with a “human handover” mechanism, meaning the AI is constantly monitoring for moments when human involvement would be more valuable, such as when customer sentiment declines, when the AI struggles to interpret input, or when a VIP caller requires special attention. In these cases, the system seamlessly transfers the conversation or process to a human operator.

The goal is simple but profound: to keep humans in control of technology. After all, technology should never exist for its own sake. Whether in banking or any other field, its purpose must always be to serve people, not replace them.

What Does a Human-Centered Future for AI Look Like?

As AI continues to evolve, so too must our approach. Gatt closed the discussion with a reminder that technology’s impact is contingent on human values:

“AI can transform society, but only if we recognise the hidden costs and commit to using it in ways that respect human values.”

The takeaway is clear: harnessing AI responsibly requires vigilance, ethical foresight, and an understanding of both tangible and intangible costs. For leaders, policymakers, and users alike, the challenge is to embrace AI not just as a tool, but as a force that must be guided by transparency, accountability, and humanity.

How Did BOV Transform Customer Service with AI?

In an effort to streamline processes, reduce manual workload, improve response times, and enhance overall customer experience, BOV partnered with EBO to implement an innovative AI solution.

At the heart of this transformation is Bovey, an AI Virtual Agent that now handles 75% of all conversations autonomously, enhancing customer interactions, efficiently capturing data, and streamlining lead qualification.

By leveraging EBO’s advanced AI technology, BOV has not only increased scalability and automated key processes, but also aligned its customer service approach with today’s digital expectations. Now, Bovey completes 80% of operational tasks such as loan inquiries, card queries, and appointment management, resulting in a 90% customer satisfaction rate.